Upcoming National Carbon Pricing Accelerates Energy Transition Away from Coal Power

The implementation of national carbon pricing means that coal plant managers may have to pay for carbon emissions from power generation, leading to higher generation costs, and they may suffer losses in future and even be forced to decommission coal plants before the normal end of plants’ technical lifetime.

As the country with the world’s largest coal power capacity, China is attempting to build its nationwide carbon market. The upcoming national carbon pricing may provide an impetus to phase out coal power and achieve its carbon peaking and carbon neutral targets early.

A systematic evaluation of the national carbon pricing effect on phasing out China’s operating coal plants is conducted by a collaborative research team from Institutes of Science and Development of Chinese Academy of Sciences (CASISD), North China Electric Power University, University of Chinese Academy of Sciences, Tianjin University of Finance and Economics, and Beihang University.

This work was published in iScience.

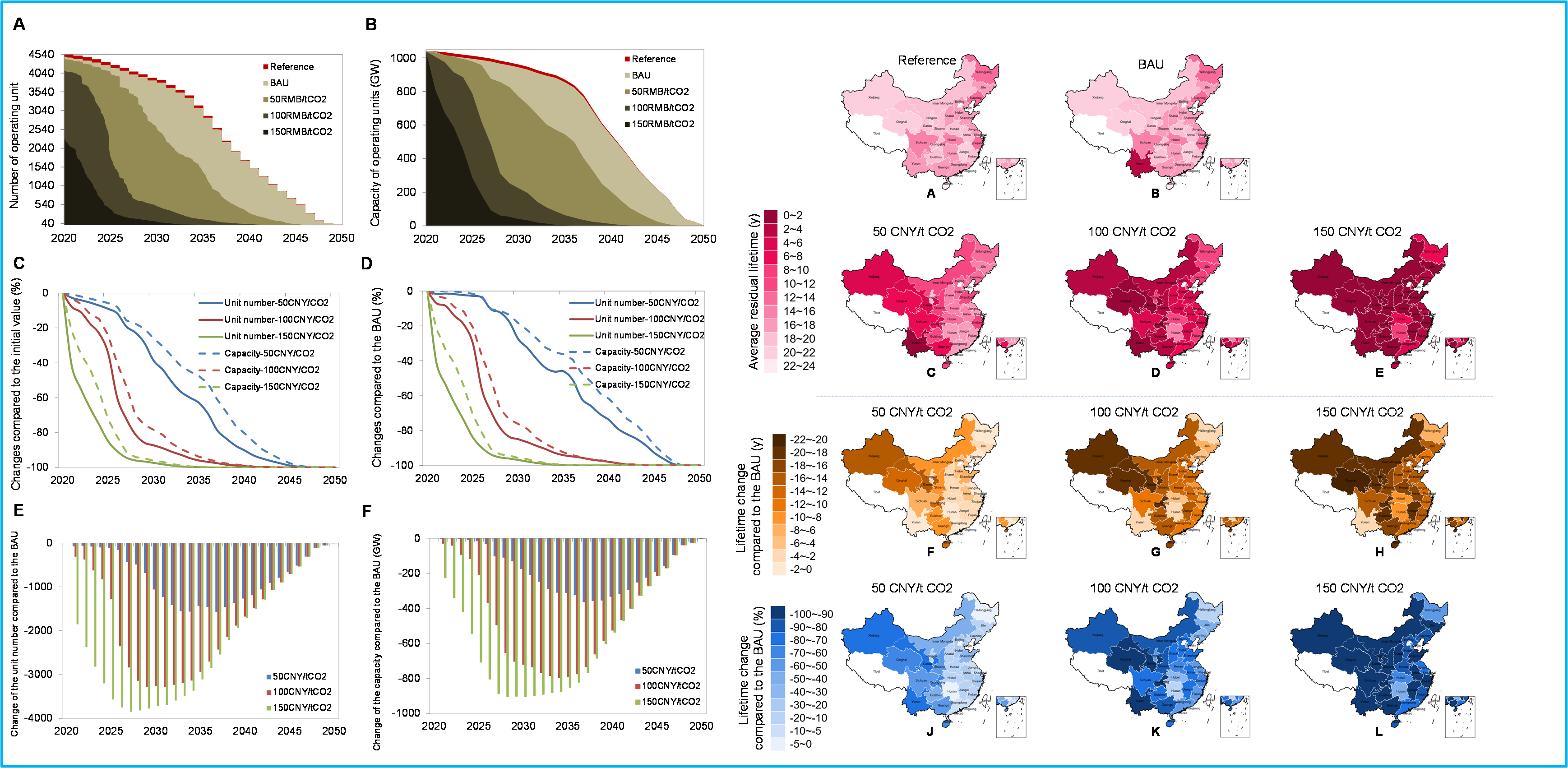

They collect full-sample data of China’s 4540 operating coal plant units and develop a stochastic Monte-Carlo financial model to assess the financial sustainability of the plant operation, and the lifetime change of each plant unit induced by carbon pricing is quantified.

It is found that although China’s operating coal plant units are young and have a long residual technical lifetime, many of their operations are close to the break-even state with the current policy and market conditions. The newly introduced carbon pricing may become "the straw that broke the camel's back".

The carbon pricing effect on phasing out China’s coal power are mainly determined by the carbon price evolution, carbon permit allocation methods and the pass-through of the carbon cost to the consumer. Even with low initial carbon price of 50 CNY/tCO2 growing at 4%/y and the permits being fully auctioned, the average residual lifetime of all the plants will be reduced by 5.43 years, and the cumulative CO2 emission from 2020 to 2050 will be reduced by 22.73 billion tons. With the carbon price further reaching 100 CNY/tCO2, the operating coal plant stock is expected to be phased out 6 years earlier.

Moreover, the disparity in the carbon pricing effect among China’s 29 provinces, autonomous regions and municipalities is significant and the western regions are more vulnerable to the carbon pricing risk than the eastern regions, with the residual lifetime being shortened by between 0.34 and 15.71 years via the carbon price of 50 CNY/tCO2.

It is proposed that the potential investors should fully recognize the risk of coal plant becoming stranded assets. Financial institutions should be prudent when deciding whether to provide finance for carbon-intensive energy investment.

For the government, when they make future development plans for the energy sector (e.g., the 14th Five Year Plan during the period of 2021-2025), the carbon pricing policy and the energy policy should be coordinated with each other to avoid future large-scale stranded assets or policy failure. Moreover, it is recommended that the local governments should avoid taking the one-size-fits-all approach when making carbon-peaking and carbon-neutral targets and the roadmap should be diversified.

The carbon pricing effect on the coal plant unit number, coal power capacity, and the expected lifetime in China’s 29 provinces, autonomous regions, and municipalities. (Image by CASISD)

(Paper published: May 26, 2021)